Contents:

Lower settings will make the average directional index respond more quickly to price movement but tend to generate more false signals. Higher settings will minimize false signals but make the average directional index a more lagging indicator. If we talk about the average directional indicator then the trader can not only use it only for the trend strength or direction of the trend. This average directional indicator can also be used for knowing the best trading strategy in a number if strategies. It is a tool that is both a trend indicator and an oscillator, which can be used on different markets, for example in forex trading or trading CFDs. Auxiliary lines (+DI, -DI) show the trend direction, and the main line determines its strength.

You need a place precisely to move after you enter a position, no matter what type of trader you are! Profits can only be made by following the path of your trade. Your financial goals can be achieved with the help of the ADX indicator trading rules. For the best ADX strategy, it’s crucial to determine which technical indicator you will use. Firstly, this average directional indicator compares different indicators and the Trading Strategies Guides and then match the result. After knowing the result, it selects one that gives the better result for the market trading.

How to use ADX indicator for swing trading

In a strong trend as it’s defined by the ADX indicator that’s precisely what we want to see. Swing trading with the ADX indicator is a lot easier because after all the trend strength indicator works better for position trading. The ADX reading above 25 indicates that momentum can be maintained in the new direction when the price breaks out.

The conservative option is based on the first signal, as shown in the example, or by a point stop. The high-risk one is based on setting stops at a 30-point distance and holding the trade for more than one day. This isn’t recommended, but you need to work intuitively and improvise in trading. Here, I notice the same conditions, but the ADX indicator has already crossed the 20% mark. While observing the open trade, I simultaneously monitor the situation on an hourly interval. After 30 minutes, the oscillator rose above 20% on an hourly interval.

Bear Flag Trading Strategy Guide PDF (

It will give you earlier signals to market conditions so that you can employ the correct trading strategies. So, for this strategy, we’ll keep our price charts clean, without plotting a lot of indicators. We will focus on reading price in order to increase our chances to swing trade the right way. Keltner Channel is practically a hybrid between an exponential moving average and the Average True Range indicator. The Keltner Channel is an underrated indicator, not used by many traders.

https://forexhero.info/ will meander sideways under 25 until the balance of supply and demand changes again. The direction of the ADX line is important for reading trend strength. When the ADX line is rising, trend strength is increasing, and the price moves in the direction of the trend. When the line is falling, trend strength is decreasing, and the price enters a period of retracement or consolidation.

Automatic Fibonacci Retracement Indicator for MT4

There’s https://traderoom.info/scussion as to whether the Anisotropic 2x or Bilinear filter setting is the right choice, but a majority of pros use the former. Turning off this setting will cause edges and objects to sharpen while simultaneously saving performance. Meant to decrease the resolution to match your target frame rate, this setting only leads to jarring jumps in quality. Be sure to turn it off for consistent graphic fidelity and input lag. NVidia Reflex is a new setting that reduces input lag for users running NVidia graphics cards.

FDA hands first emergency authorization to over-the-counter test for … – FierceBiotech

FDA hands first emergency authorization to over-the-counter test for ….

Posted: Mon, 27 Feb 2023 15:01:46 GMT [source]

There is, however, the potential for an unsustainable breakout if the ADX reading is below 25. Overall, the ADX can be a valuable tool for Forex traders looking to improve their trading strategies and make more informed decisions. The direction of the positive directional index (DI+) and negative directional index (DI-) can be used to confirm the direction of a trend. If the DI+ is above the DI-, this may indicate an uptrend, while if the DI- is above the DI+, this may indicate a downtrend.

Which indicator works best with ADX?

If you are know about it then you are going to start loving and enjoy it. It is great blend of future and past experiences that you have and knowledge about it can help you a lot. Adx has a great demand and features that can help you to provide best results of trading hours. Forex trading is not for the faint of heart, and finding the right strategy makes the difference between striking gold and losing your shirt. One strategy that has recently been making waves in the industry is grid… Many market participants believe demo accounts are only suitable for beginners in the Forex market.

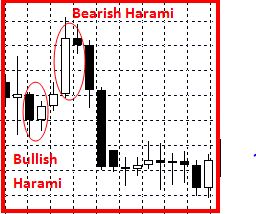

- At the time of a crossover, the main line is below the 20% level and, after that, the dotted lines start moving upward.

- Traditionally an ADX value above 20 indicates a trending market.

- If you look on the web, this is the standard setup you will find.

- It’s a versatile indicator, and as shown in this article, could also be used as a mean-reverting tool, not as a trend-tool as it was originally made to be.

I recommend trying to https://forexdelta.net/ with a reliable broker here. The system allows you to trade by yourself or copy successful traders from all across the globe. You need to analyze where the main oscillator line is located and the +DI and -DI lines relative to each other.

The results are good, but not nearly good enough to be used on its own. How does the crossover perform on futures and other ETFs? Even on commodities, we fail to produce better numbers than in the S&P 500. Average Directional Movement Indexbut is known as the ADX indicator.

The two oscillators complement each other perfectly and compensate for each other’s weak points. Add the support and resistance levels to the strategy, see whether any patterns form. Patterns and breakout/bounce of levels are additional signals. On the hourly interval, the ADX drops, signifying the convergence of the dotted lines. And if I did that, my profit potential would be just over $30.

What is the best setting for ADX indicator?

The Holy Grail combines the ADX with a moving average to find pullbacks using price action. While it’s not a trading strategy per se, it’s a tool for finding more conservative signals. In any approach that uses the ADX, you can opt to replace it with the ADXR. This substitution will filter out the more aggressive signals. J. Welles Wilder was a prolific designer of trading indicators that have survived the test of time.

- Whether it is more supply than demand, or more demand than supply, it is the difference that creates price momentum.

- You have to use common sense sometimes and know what’s real and what’s clearly a scam.

- Comment below if you need templates for these indicators or if you don’t know how to download ADX in a modified version.

- In the sections below, you’ll find the best gear currently being used by pro players.

- When the ADX line rises, it indicates that the trend is strengthening, so you should trade in the direction of the highest DI line.

- And as is often the case in mean reversion, sudden and prolonged moves in one direction tend to result in a market reversal.

The Average Directional Movement , developed by Welles Wilder, is an indicator that measures trend strength and shows trend direction. There are many ways to use the ADX in trading strategies. Our research and backtests indicate the ADX indicator is somewhat useful on its own but adds great value used alongside other indicators when you build trading strategies. In this article, we look at how the Average Directional Movement performs alongside other indicators, and we test some ADX trading strategies. The ADX is a technical indicator used to determine the strength of the trends in the market. Arrow indicators for binary options are the tools for “the lazy”.

It has a pullback strategy that can help you to get profit and covered all type of trading lines and give you profit in less time. It has a frame that have potential to measure strength pf using these strategies, these are very important skills that have traders to use it. A crossing of the -DI line over the +DI line indicates that negative price changes in the market are greater than positive price changes. This is a solid signal to place a sell order if the ADX is below 25. Using trailing stops or exiting your trade position entirely can protect your capital if the –DI line crosses above +DI while you are in a long position.

On the other hand, its moving average only measures how strong a trend is at any given point in time. Trend strength is a scan that traders can use to narrow down their focus list. While you can see the same thing by reading price action, it is a fast and dirty way to scan through your charts to find where your focus should be.