Contents:

The defaults are also updated a bit per my own personal preference but those of course can be changed. Onacci Speed Resistance Fan consists of a trend line drawn between two extreme points – a trough and opposing peak or a peak and opposing trough – on… Just noticed the correlation of SMAs and fibonacci on my charts. There is nothing needed to calculate a Fibonacci arc, although, here are steps and examples to help understand how they are drawn. MultiCharts .NET allows you to build your strategy out of many trading signals.

Highly efficient fiber-shaped organic solar cells toward wearable … – Nature.com

Highly efficient fiber-shaped organic solar cells toward wearable ….

Posted: Tue, 07 Jun 2022 07:00:00 GMT [source]

Typically, these two points represent a high and a low during a specified time period. Next, the vertical distance between these two points is divided by three primary Fibonacci ratios – 38.2%, 50% and 61.8%. The three resulting numbers each signify a level within the vertical distance and are included as points on the chart.

Fibonacci Fans vs. Gann Fans

The behavior of the price on this line allows deciding finally that there is − a correction or a turn. In practice breakthrough of a beam 76,4% means that with identification and an entrance on a turn were already late. After a Speed/Resistance Fan is applied to a chart, you can reposition the drawing object at any time to evaluate another group of bars. In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. You may use it for free, but reuse of this code in a publication is governed by House Rules. One can create custom toolbars with Multicharts .NET. If existing toolbars are not enough, you can easily create custom ones to suit your needs.

I’ve only done basic R&D and concluded that for best results, Beginbar has to be set to nearest low. I guess using 52 week low for begin bar and 52 week high for end bar would be good common-place scenario. To learn more about how to add this annotation to your charts, check out our Support Center article on ChartNotes’ Line Study Tools. You can use our ChartNotes annotation tool to add Fibonacci Fans to your charts.

Inserting Fibonacci Speed/Resistance Fan

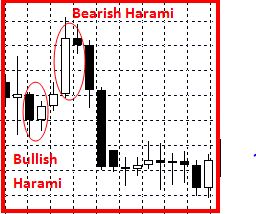

Once a trader has identified patterns in a chart, he or she can use those patterns to forecast future price movements as well as future levels of support and resistance . The forty five-degree line should extend out forty five-levels from the place to begin. A hand-drawn trendline connects a swing low to a swing low, or a swing high to swing high, and then extends out the best.

These vertical lines are spaced according to the Fibonacci number sequence (0, 1, 1, 2, 3, 5, 8…). Distances start relatively small and grow as the Fibonacci sequence extends. (Some of the lines will probably not be visable because they will be off the scale.)After a significant price move , prices will often retrace a significant portion of the original move. These lines are drawn based on time/price percentages of the distance between the beginning and the end of the trend line .

- Once the level is found that intersects the arc, draw a perfect circle using point A as the anchor.

- These lines can indicate the support and resistance levels of an existing trend.

- If you’ve been following all of those steps, all the different Gann fan angles ought to adjust to the Gann rules.

Let’s remind briefly characteristics of the used necessary tools. Resistance to Speed Fan lines can also be used to represent support or resistance lines. Price frequently remains above the higher speed line during an upswing. When this line is breached, prices often fall to the lower speed line, which often becomes the support level . If prices fall below the higher speed line, then climb to the lower speed line, the lower speed line becomes the resistance level .

TradingViewPlatformWikiCn/book/06/1/Fib_Speed_Resistance_Fan.md

When confirmed by support and resistance, regular trends and technical patterns, they round out the technician’s tool box. Tirone levels are a series of three sequentially higher horizontal lines used to identify possible areas of support and resistance for the price of an asset. Fibonacci retracement levels are horizontal lines that indicate where support and resistance are likely to occur. Fibonacci clusters are areas of potential support and resistance based on multiple Fibonacci retracements or extensions converging on one price. The arcs are derived from the base line that connects a high and a low.

When evaluating online brokers, always consult the broker’s website. Lawrence Pines is a Princeton University graduate with more than 25 years of experience as an equity and foreign exchange options trader for multinational banks and proprietary trading groups. Mr. Pines has traded on the NYSE, CBOE and Pacific Stock Exchange. In 2011, Mr. Pines started his own consulting firm through which he advises law firms and investment professionals on issues related to trading, and derivatives. Lawrence has served as an expert witness in a number of high profile trials in US Federal and international courts. Can toggle the visibility of the left, right, top and bottom labels with levels’ values.

Formatting the Fibonacci Speed/Resistance Arc Settings

fib speed resistance fan the Hide Time check box to turn off the display of Divide Time lines. Can change the visibility and color and values of the price levels. The Fibonacci retracement tool plots percentage retracement lines based upon the mathematical relationship within the Fibonacci sequence. Fibonacci extensions are a method of technical analysis commonly used to aid in placing profit targets.

These angles are superimposed over a worth chart to show potential assist and resistance ranges. The resulting image is supposed to help technical analysts predict worth modifications. Gann fans draw lines at different angles to show potential areas of help and resistance. Cycle theory asserts that cyclical forces, both long and short, drive price movements in the financial markets. Some will miss, some will disappear and some will provide a direct hit. Fibonacci Time Zones analytical drawing tool is represented by a series of vertical lines, and it indicates significant price movements near them.

MultiCharts was recognized as the best trading platform for several years in a row. A pair of parallel lines can be used to outline the equidistant channel in which the market trades. Commodity.com is not liable for any damages arising out of the use of its contents. Commodity.com makes no warranty that its content will be accurate, timely, useful, or reliable. Nevertheless, the Fibonacci sequence is applied to individual stocks, commodities, and forex currency pairs quite regularly.

A Speed/Resistance Fan consists of an underlying trendline on which speed resistance lines are drawn above and below . These speed lines are drawn based on time/price percentages of the distance between the beginning and end of that underlying trendline. The typically-debated matter of dialogue amongst technical analysts is that the past, the present and the longer term all exist on the identical time on a Gann angle. This trading strategy is a complex assist and resistance buying and selling technique. Unlike the traditional horizontal support and resistance levels, the Gann fan angles are mathematically calculated based mostly on the value, time and the value vary of the market. Traders will draw a Gann fan at a reversal point to see support and resistance levels extended into the future.

- These lines are drawn based on time/price percentages of the distance between the beginning and the end of the trend line.

- This is because investors and traders take a lot more profit off their trades during gradual movements, causing much deeper retracements to take place.

- The most common percentages are 1/3 and 2/3, but you can draw up to 11 lines based on any selected distance percentages as well as on the Fibonacci percentages.

- For example, both 23.6% levels should be at the same price on the chart.

But it doesn’t mean that its technique isn’t suitable for trade in the foreign exchange market. Approaches to determining the amplitude of movement of the price in case of movement of the price in the direction of the main trend. The central part of a Fan determines the urgent range of support/resistance. Eight main corners determine additional power lines depending on the direction of movement of the price.

Once a support line gives, for instance, the 2X1 line, it turns into resistance, and the next one, 3X1, turns into support. Each retracement is derived from the vertical “trough to peak” distance divided by ratios in the Fibonacci sequence. As we stare into the start of the third quarter a few interesting developments have been taking place. This material on this website is intended for illustrative purposes and general information only. Select the Divide Time/Price Separately check box to construct an arc where time and price are independent of one another.

After Idaho Murder Suspect Bryan Kohberger Arrives in Idaho; New … – arlingtoncardinal.com

After Idaho Murder Suspect Bryan Kohberger Arrives in Idaho; New ….

Posted: Fri, 06 Jan 2023 08:00:00 GMT [source]

When SPX started to move above its Mhttps://1investing.in/h low, it met slight resistance at the 23.6% level. Even though it broke above it, the close was right around that level. Traders mark these levels because they have historically shown relevance in trading markets. In the crypto markets, Fibonacci Retracement Levels are horizontal lines that denote support and resistance levels for a particular asset’s price chart.